Can You Master Your Finances? 9 Top Scholarship Budget Tips!

Discover the secrets to mastering your finances while studying online with a scholarship! Effective budgeting is key to managing your expenses, maximizing your scholarship funds, and achieving financial stability. Dive into this article to uncover the best scholarship budget tips, strategies, and expert advice that will empower you to take control of your financial journey and thrive as an online student with a scholarship.

Managing your finances and budget while studying online with a scholarship is a crucial skill that can set you up for long-term financial success. People are seeking for ways to save money all the time. In this article, we will delve into the secrets of effective budgeting and financial management for online students with a scholarship. Discover practical strategies, expert advice, and valuable resources to help you navigate your financial journey and make the most of your scholarship funds.

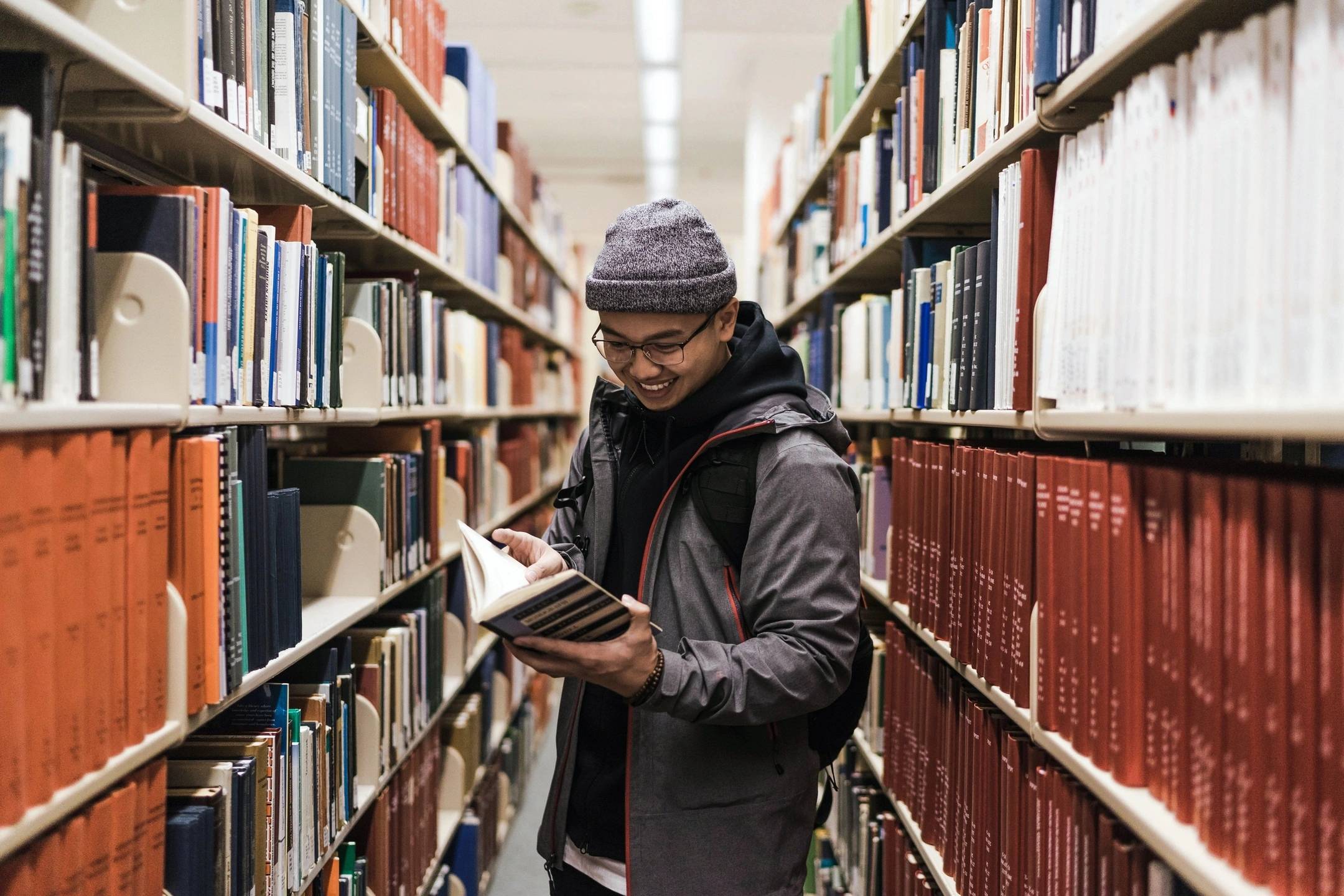

Understanding Your Financial Situation:

To master your finances, start by assessing your income, expenses, and financial goals. Take stock of your scholarship benefits and any additional financial aid you may receive. Understanding your financial situation is the first step towards creating a solid budgeting plan.

Understanding your financial situation is a crucial step in mastering your finances while studying online with a scholarship. By assessing your income, expenses, and financial goals, you can gain a clear understanding of your financial landscape and make informed decisions about budgeting and financial management. Here are key aspects to consider when understanding your financial situation:

- Assessing your income: Start by evaluating your sources of income, including your scholarship funds, part-time job earnings, or any other financial support you receive. Understanding the amount and frequency of your income will help you establish a baseline for budgeting and financial planning.

- Identifying your expenses: Take a comprehensive look at your expenses, including tuition fees, textbooks, housing, utilities, transportation, food, and other living expenses. Categorize your expenses to gain a better understanding of where your money is going and identify areas where you can potentially cut back or optimize spending.

- Evaluating your financial goals: Reflect on your short-term and long-term financial goals. Are you saving for a specific purpose, such as further education, a down payment on a house, or starting a business? Understanding your financial goals will help you align your budgeting efforts and prioritize your spending accordingly.

- Considering your scholarship benefits and additional financial aid: Take into account the specific terms and conditions of your scholarship, such as the duration, amount, and any restrictions on how the funds can be used. Additionally, consider any other financial aid or grants you may be eligible for and factor them into your financial planning.

By thoroughly understanding your financial situation, you can make informed decisions about budgeting, saving, and spending. This knowledge will empower you to create a reasonable budget, set financial goals, and make the most of your scholarship funds while studying online. Remember, regularly reassessing your financial situation throughout your academic journey will help you stay on track and make necessary adjustments as needed.

Creating a Realistic Budget:

Developing a good budget is essential for effective financial management. Track and categorize your expenses, set spending limits, and allocate funds for tuition, books, living expenses, and savings. A well-planned budget will help you stay on track and make informed financial decisions throughout your online study journey. (Source: Investopedia – How to Create a Budget)

Creating an acheivable budget is a crucial step in mastering your finances while studying online with a scholarship. A well-planned budget helps you allocate your funds effectively, prioritize your expenses, and ensure that you are living within your means. Here are key strategies to consider when creating a resonable budget:

- Track and categorize your expenses: Start by tracking your expenses for a few months to get a clear picture of where your money is going. Categorize your expenses into different categories such as tuition, textbooks, housing, transportation, groceries, entertainment, and miscellaneous. This will help you identify areas where you can potentially cut back or optimize your spending.

- Set spending limits and financial targets: Once you have a clear understanding of your expenses, set spending limits for each category based on your financial goals and priorities. For example, you may decide to allocate a certain percentage of your income towards tuition and educational materials, a specific amount for housing and utilities, and a limited budget for entertainment and discretionary expenses.

- Allocate funds for tuition, books, living expenses, and savings: Break down your budget into specific allocations for different expenses. For example:

- Tuition and educational materials: Allocate a specific amount for your tuition fees, textbooks, online course subscriptions, and other educational resources.

- Living expenses: Set aside a portion of your budget for housing, utilities, groceries, transportation, and other essential living expenses.

- Savings: Prioritize saving a certain percentage of your income for emergencies, future educational expenses, or long-term financial goals.

- Regularly review and adjust your budget: Your budget should be a dynamic tool that evolves with your changing circumstances. Regularly review your budget to ensure that it aligns with your current financial situation and goals. Make adjustments as needed, such as reallocating funds from one category to another or finding ways to optimize your spending.

Example:

Let’s say you receive a scholarship that covers your tuition fees and provides a monthly stipend of $500. Here’s an example of how you could allocate your budget:

- Tuition and educational materials: $0 (covered by the scholarship)

- Housing and utilities: $300

- Groceries: $150

- Transportation: $50

- Entertainment and discretionary expenses: $50

- Savings: $50

In this example, you have allocated your funds based on your essential expenses and have set aside a portion for savings. Adjust the amounts based on your specific circumstances and financial goals.

By creating a proper budget and sticking to it, you can effectively manage your finances, avoid overspending, and make the most of your scholarship funds while studying online. Regularly tracking your expenses and reviewing your budget will help you stay on track and achieve your financial goals.

Strategies for Saving and Maximizing Scholarship Funds:

Implementing cost-saving measures, exploring student discounts and resources, and utilizing your scholarship funds wisely are key strategies for maximizing your financial resources. By adopting these strategies, you can make the most of your scholarship funds and ensure that your money is working for you. (Source: U.S. News – How to Make the Most of Your Scholarship)

Strategies for saving and maximizing your scholarship funds are essential to make the most of your financial resources while studying online. By implementing these strategies, you can stretch your scholarship funds further and ensure that you are optimizing your financial situation. Here are key strategies to consider:

- Implement scholarship budget tips:

- Rent and housing: Consider sharing accommodation with roommates to split expenses or explore more affordable housing options.

- Transportation: Opt for cost-effective transportation methods such as public transit, carpooling, or biking instead of owning a car.

- Food and groceries: Plan your meals, cook at home, and buy groceries in bulk to save on dining out expenses.

- Entertainment and leisure: Look for free or low-cost activities, such as community events, outdoor activities, or utilizing student discounts.

- Explore student discounts and resources:

- Textbooks and educational resources: Consider renting textbooks, buying used books, or utilizing online resources and libraries to save on educational materials.

- Software and technology: Take advantage of student discounts on software, technology, and online subscriptions for productivity tools, software licenses, or streaming services.

- Health and wellness: Utilize student health services and explore discounted gym memberships or fitness classes offered to students.

- Utilize scholarship funds wisely:

- Tuition and fees: Ensure that your scholarship funds are allocated towards tuition and fees, maximizing the financial support provided by the scholarship.

- Essential educational expenses: Use your scholarship funds to cover necessary educational expenses such as textbooks, online course subscriptions, or specialized software required for your program.

- Prioritize needs over wants: Differentiate between essential expenses and discretionary spending, and prioritize your needs to make the most of your scholarship funds.

- Avoid unnecessary expenses:

- Evaluate your spending habits: Regularly review your expenses and identify areas where you can cut back or eliminate unnecessary spending.

- Differentiate between needs and wants: Before making a purchase, ask yourself if it is a necessity or a luxury. Avoid impulsive buying and focus on your financial goals.

- Be mindful of lifestyle inflation: As your income increases, be cautious of increasing your expenses proportionally. Instead, consider saving or investing the additional funds.

- Consider paid internships placements and practicums:

- Paid internships, placements, and practicums are all types of structured learning experiences that students can participate in to gain real-world work experience in their field of study. The main difference between the three is that internships are typically more focused on hands-on training and experience, while placements and practicums are more focused on academic credit and meeting specific program requirements.

- They can be of great help to students financially. By earning an income while they are working, students can reduce their reliance on student loans and other forms of financial aid. This can make it easier for students to afford their education and graduate with less debt.

Example:

Let’s say your scholarship provides a monthly stipend of $500. By implementing cost-saving measures, such as sharing accommodation and utilizing public transportation, you can save approximately $200 per month. Additionally, by taking advantage of student discounts on textbooks and educational resources, you can save an estimated $100 per semester. By utilizing these strategies, you can save a total of $2,400 per year, maximizing your scholarship funds.

By implementing these strategies for saving and maximizing your scholarship funds, you can make your financial resources go further while studying online. By being mindful of your expenses, exploring student discounts, and utilizing your scholarship funds wisely, you can optimize your financial situation and ensure that you are making the most of your educational journey.

Managing Debt and Student Loans:

Understanding the implications of student loans, developing a repayment plan, and exploring options for loan forgiveness or repayment assistance are crucial steps in managing your debt. By staying informed and proactive, you can effectively manage your student loans and minimize their impact on your financial well-being. (Source: Federal Student Aid – Managing Your Loans)

Managing debt and student loans is a crucial aspect of financial management while studying online with a scholarship. By understanding the implications of student loans, developing a repayment plan, and exploring options for loan forgiveness or repayment assistance, you can effectively manage your debt and minimize its impact on your financial well-being. Here are key strategies to consider:

- Understand the implications of student loans:

- Research loan terms and conditions: Familiarize yourself with the terms of your student loans, including interest rates, repayment periods, and any applicable grace periods or deferment options.

- Estimate future monthly payments: Use loan calculators to estimate your future monthly payments based on your loan amount, interest rate, and repayment term. This will help you plan your budget and understand the financial commitment involved.

- Be aware of the long-term impact: Recognize that student loans can have a long-term impact on your financial health, including your credit score and ability to qualify for other loans or mortgages.

- Develop a repayment plan:

- Create a budget: Incorporate your student loan payments into your budget and ensure that you allocate sufficient funds each month to cover your repayment obligations.

- Explore repayment options: Research different repayment plans, such as standard repayment, income-driven repayment, or extended repayment, and choose the one that aligns with your financial situation and goals.

- Prioritize loan repayment: Make student loan repayment a priority and allocate any extra funds, such as tax refunds or bonuses, towards paying down your debt.

- Explore options for loan forgiveness or repayment assistance:

- Public Service Loan Forgiveness (PSLF): If you work in a qualifying public service job, you may be eligible for loan forgiveness after making 120 qualifying payments.

- Income-driven repayment plans: If you have a high debt-to-income ratio, income-driven repayment plans can help make your monthly payments more manageable based on your income and family size.

- Loan repayment assistance programs: Some professions or organizations offer loan repayment assistance programs as a benefit to employees. Research if you qualify for any such programs.

- Seek financial counseling or guidance:

- Consult a financial advisor: Seek guidance from a financial advisor or counselor who specializes in student loans and debt management. They can provide personalized advice based on your specific circumstances and help you navigate your repayment options.

- Utilize resources provided by your institution: Many educational institutions offer financial aid offices or resources that can provide guidance and support in managing student loans.

Example:

Let’s say you have $30,000 in student loan debt with an interest rate of 5% and a 10-year repayment term. By using a loan calculator, you estimate that your monthly payment will be approximately $318. Incorporating this amount into your budget and making consistent payments will help you stay on track with your loan repayment.

By understanding the implications of student loans, developing a repayment plan, and exploring options for loan forgiveness or repayment assistance, you can effectively manage your debt and minimize its impact on your financial well-being. By staying informed and proactive, you can take control of your student loans and work towards achieving financial freedom.

11 Amazing Crowdfunding Sites That Could Help Fund Your Dream Scholarship

Getting a prestigious scholarship can feel like an impossible dream when you’re worried about how to pay for your education. But did you know there are crowdfunding platforms that could help bring your dreams within reach?

This article will introduce 20 top crowdfunding sites students can use to help fund their dream scholarship through community support and donations. By crafting a compelling story and promoting it widely, crowdfunding has the potential to demonstrate your drive, ambition and community backing to scholarship selection committees.

Why Consider Crowdfunding for Scholarships?

Scholarship selection is highly competitive, with many worthy applicants for a limited number of awards. Financial need is also a major factor in who receives most prestigious scholarships. This is where crowdfunding comes in – it allows you to showcase your needs to potential donors and help secure critical funding.

Crowdfunding gives selection committees visual proof of both your academic merit through qualifications and your ambition through community support. When done effectively, it serves as evidence of your initiative, interpersonal skills and ability to achieve goals – all attributes top scholarships seek.

The 11 Best Crowdfunding Sites For Scholarships

- Indiegogo – One of the original crowdfunding platforms great for getting creative projects and educational goals supported.

- Fundly – User-friendly site that allows donors to support individuals and organizations through various fundraising campaigns.

- Kickstarter – Best known for creative and arts projects but will also back educational endeavors with proven track record.

- GoFundMe – Largest platform focuses on personal causes so great for scholarships, study abroad programs and more.

- GoGetFunding – International site that effectively raises money for personal causes through community support.

- Fundable – Specializes in startup investments and has backed some student ventures and research projects before.

- Fund My Travel – As the name implies, helps fund experiences like study abroad, internships and conferences.

- Crowdfunder – Community driven platform that connects projects to investors and donors online.

- Ulule – European equivalent of Kickstarter focused on bringing creative and civic-minded projects to life.

- CircleUp – Primarily for investing in consumer product companies but has supported student entrepreneurs before.

- CrowdRise – Professional fundraising platform that empowers charities and individuals to raise money for various causes.

The key to successful crowdfunding is attracting donors through a compelling narrative. Tell your unique story, outline your academic and career goals clearly and paint a vivid picture of the impact donors can make. Promote widely on social media and through your personal networks. Express gratitude by updating supporters on your progress. Maintaining momentum over the campaign duration is also important to maximize your fundraising chances.

Tips for Compliance

Before launching your scholarship campaign, check your school’s policies on personal fundraising. Ensure any funds raised can be used legitimately for education according to the specific scholarship rules. Keep financial transparency with regular updates on spending. Only promote your qualified credentials for the award and use crowdfunding to supplement your application, not replace it.

Sample Campaign Ideas

Some potential crowdfunding project ideas could be furthering your research in your chosen field through a conference attendance or lab resources. Other examples are offsetting the costs of a study abroad experience or internship that could help you stand out to selectors. Get creative and think of how crowdfunding can help fuel unique opportunities related to your scholarship goals.

Conclusion:

Mastering your finances while studying online with a scholarship is within your reach. By understanding your financial situation, creating a suitable budget, and implementing these effective scholarship budget tips, you can achieve financial stability and success. Take control of your financial journey, make informed decisions, and thrive as an online student with a scholarship.

What is the 50 30 20 rule?

The 50/30/20 rule is a budgeting technique that involves dividing your after-tax income into three primary categories:

50% for needs

30% for wants

20% for savings and debt repayment

Needs are essential expenses that you must pay in order to live, such as housing, food, transportation, and utilities. Wants are discretionary expenses that you can choose to spend money on, such as dining out, entertainment, and travel. Savings and debt repayment includes money that you are saving for future goals, such as retirement or a down payment on a house, as well as money that you are using to pay off debt.

The 50/30/20 rule is a simple and effective way to create a budget that helps you to meet your financial goals. It is also a flexible budget that can be adapted to fit your individual needs and circumstances.

What should I spend my scholarship money on?

The best way to spend your scholarship money is to use it to reduce your financial burden and make it easier for you to afford your education. Here are some specific ideas:

Tuition and fees: Scholarship money can be used to pay for tuition and fees, which are the largest expense for most college students.

Room and board: Scholarship money can also be used to pay for room and board, which is another major expense for college students.

Books and supplies: Scholarship money can also be used to pay for books and supplies, which are essential for students to succeed in their classes.

Transportation: Scholarship money can also be used to pay for transportation costs, such as gas, public transportation, or a parking pass.

Living expenses: Scholarship money can also be used to cover living expenses, such as food, groceries, and personal care items.

If you have any scholarship money left over after covering your essential expenses, you can consider using it to:

Pay off debt: If you have any student loans or other debt, you can use your scholarship money to pay it down. This will save you money on interest in the long run.

Save for the future: You can also use your scholarship money to save for the future, such as a down payment on a house or retirement.

Invest in yourself: You can also use your scholarship money to invest in yourself, such as by taking classes or workshops to learn new skills.

Ultimately, the best way to spend your scholarship money is to use it in a way that will help you achieve your financial goals and make the most of your education.

Further Reading:

12 Top Resources for Finding and Applying to Scholarships: Your Guide to Funding Your Education

Prestigious Scholarships: Personality’s Role in Career Paths